SPOILER ALERT!

Safeguard Yourself With These Insurance Policy Tips

Content writer-Gammelgaard Klint

In today's risky world, having some kind of insurance is pretty much accepted as compulsory- you need it to drive a car, or buy a home. However, for smaller items or fields that don't require it, it's not always clear whether insurance is worth the investment or not. This article contains some hints and ideas for helping you make sense of insurance and will suggest what schemes would best suit you.

When you choose insurance for your car, qualify your insurer first. Besides evaluating Look At This , it is also in your best interest to look for reviews on their customer service, claim responsiveness and even rate increases. Knowing who you are dealing with ahead of time can help you set expectations with your insurer.

When shopping for new insurance of any kind, be sure to get several quotes using the same coverage parameters so that you have a good idea of the market worth of the policy. Online insurance companies have made this task exceedingly easy. Select the one that seems to offer the best mix of price and coverage. It never hurts to do some online research about your prospective insurer's reliability as far as paying claims as well.

Get lower insurance rates by paying for your insurance annually or twice a year instead of monthly. Most insurance providers give a good discount for paying up-front. Additionally, many insurance providers charge a monthly fee of $2-$3 in addition to higher rates for monthly payment, so your savings can really add up when you pay in advance.

When you make an insurance claim, explain every detail about the incident. Take pictures of the damages. Don't lie or try to scam insurance companies, because you can get in trouble for this.

When you make an insurance claim, explain every detail about the incident. Any damage claims should be backed up by photographs. Don't make up stories about the damages, trying to get more money, this can get you in serious trouble.

Make sure to compare prices from multiple insurance companies before making a choice of who to sign with. Premiums can vary up to 40% between different companies for the same levels of insurance. With insurance shopping around is an absolute must if you want to get the most bang for your buck.

You may be able to save money by opting out of towing coverage on your policy. The cost of having our car towed when necessary can actually be less than what you are paying in additional fees for having this coverage. You probably won't use the towing part of the plan, especially since other areas of the policy will cover towing after an accident anyway.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When your insurance coverage is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since they already have all your information, it probably won't take 15 minutes and you can save time and money.

Ask your insurer if there are savings to be had by merging all the different types of insurance that you need. Lots of insurers provide discounts for having all policies with them and combining these policies into one.

It may sound silly but some people even invest in pet insurance! I, as an owner of two dogs, also recommenced it. You simply never know what could happen to your dogs, and they are like members of your family. This protects you in the case of a serious health condition that requires regular treatment. For example I had an epileptic dog growing up and we spent thousands on his care which could have easily been mitigated.

Contact your provider and inquire as to the discounts available for bundling policies. You'll receive a discount for using them for all of your insurance needs, but you'll get an even bigger discount if you merge all of your insurance policies into a single account.

https://s3.ca-central-1.amazonaws.com/financial-advisor-alberta-22/infinite-banking.html at different companies that offer renter's insurance and check their customer satisfaction ratings. You do not want to get coverage from a company that is going to take a long time to pay out a claim or reject it completely. Know who you are getting involved with prior to signing anything.

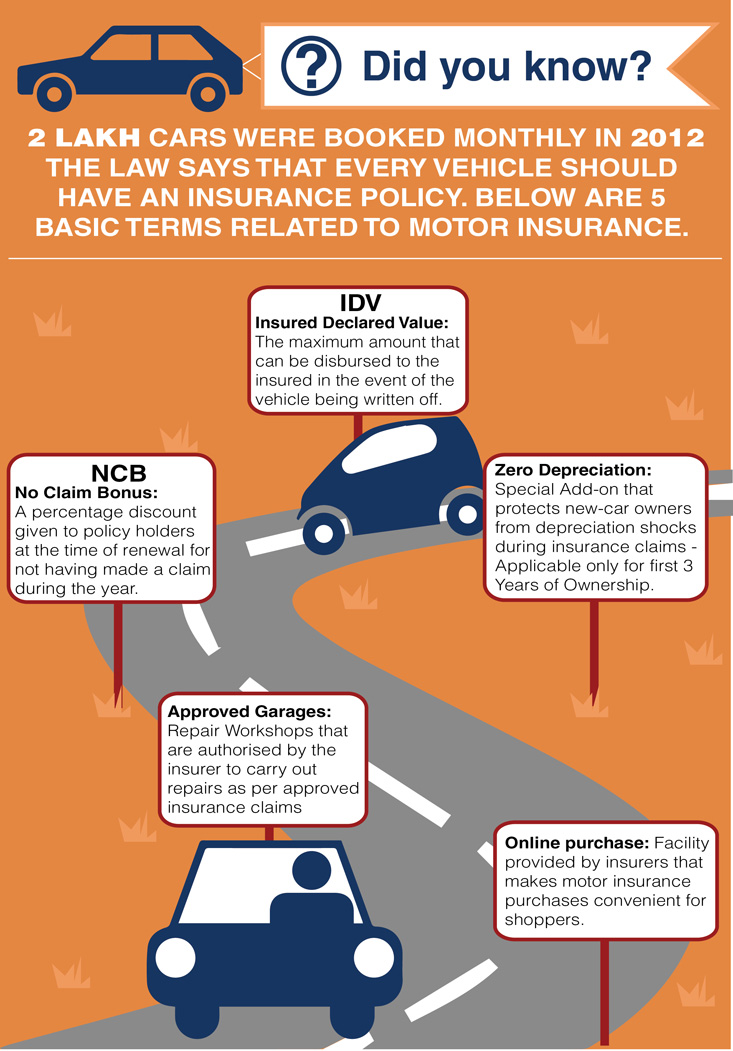

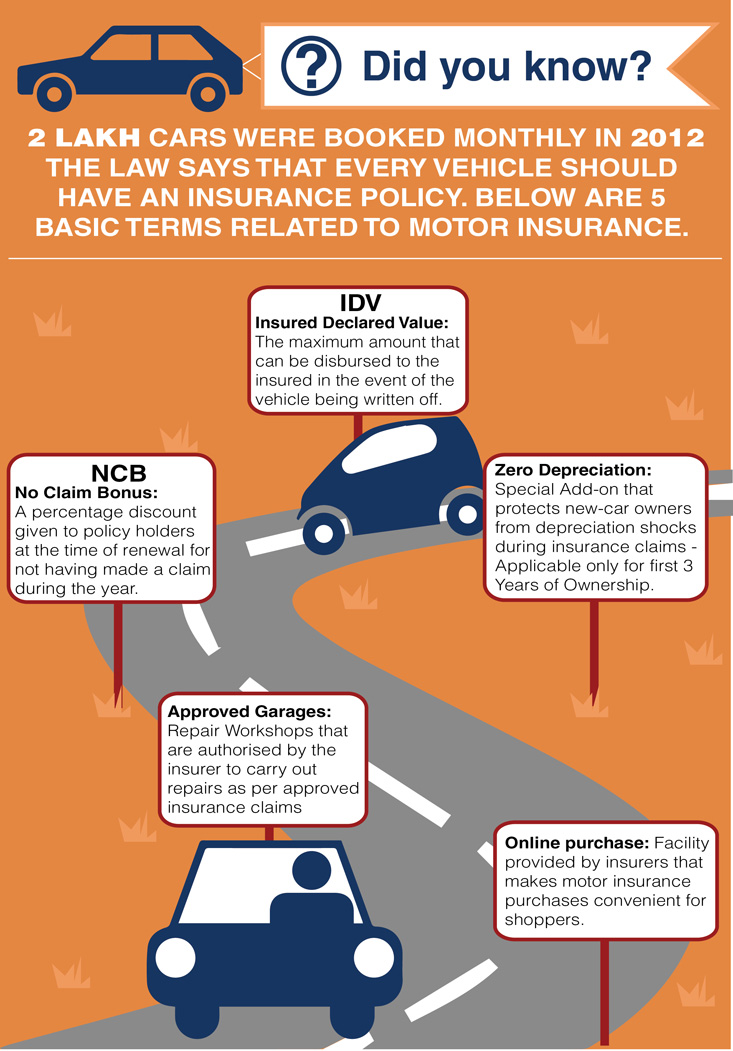

Be sure to familiarize yourself with car insurance lingo. Understand the meaning of various phrases you will encounter such as collision coverage, uninsured motorist protection, bodily injury liability, property damage liability and so forth. If you don't understand, ask questions. In this way, you will know exactly what you are paying for.

Having pet insurance can typically help with veterinary costs which can be astronomical because of cutting-edge science and procedures. Often time making the choice of choosing an expensive operation over putting the animal to sleep can be heartbreaking and opting to buy an insurance for a pet could prove to be very beneficial if your pet needs expensive health care.

It is very costly to add a teenage driver to your auto insurance policy, so it should only be done under certain circumstances. Only do this if you are positive that your teen is a safe driver and only if they have had driver's education classes, since that will decrease the likelihood of them getting into an accident.

Be sure to familiarize yourself with car insurance lingo. Understand the meaning of various phrases you will encounter such as collision coverage, uninsured motorist protection, bodily injury liability, property damage liability and so forth. If you don't understand, ask questions. In this way, you will know exactly what you are paying for.

If the option is available to you, you should always purchase your insurance from a large insurance company. Small insurance companies frequently go out of business and rarely has the personnel or technology required to provide you with the best customer service. If a small insurance company goes out of business you may lose any prepaid expenses you deposited.

If you have fire insurance and you are getting ready to file a claim, it is important to make sure you have all necessary information available. This way, you get proper coverage. On your claim, make sure to put the condition of the home, the date of the loss, the location of the damage, type of damage and loss, and related injuries.

A good education about insurance is key to everyone today. If you've got good knowledge of the industry, you can make a better decision without having to deal with negative consequences. Now with the information you just acquired you hopefully feel a little better about insurance and all of your questions have been cleared up.

In today's risky world, having some kind of insurance is pretty much accepted as compulsory- you need it to drive a car, or buy a home. However, for smaller items or fields that don't require it, it's not always clear whether insurance is worth the investment or not. This article contains some hints and ideas for helping you make sense of insurance and will suggest what schemes would best suit you.

When you choose insurance for your car, qualify your insurer first. Besides evaluating Look At This , it is also in your best interest to look for reviews on their customer service, claim responsiveness and even rate increases. Knowing who you are dealing with ahead of time can help you set expectations with your insurer.

When shopping for new insurance of any kind, be sure to get several quotes using the same coverage parameters so that you have a good idea of the market worth of the policy. Online insurance companies have made this task exceedingly easy. Select the one that seems to offer the best mix of price and coverage. It never hurts to do some online research about your prospective insurer's reliability as far as paying claims as well.

Get lower insurance rates by paying for your insurance annually or twice a year instead of monthly. Most insurance providers give a good discount for paying up-front. Additionally, many insurance providers charge a monthly fee of $2-$3 in addition to higher rates for monthly payment, so your savings can really add up when you pay in advance.

When you make an insurance claim, explain every detail about the incident. Take pictures of the damages. Don't lie or try to scam insurance companies, because you can get in trouble for this.

When you make an insurance claim, explain every detail about the incident. Any damage claims should be backed up by photographs. Don't make up stories about the damages, trying to get more money, this can get you in serious trouble.

Make sure to compare prices from multiple insurance companies before making a choice of who to sign with. Premiums can vary up to 40% between different companies for the same levels of insurance. With insurance shopping around is an absolute must if you want to get the most bang for your buck.

You may be able to save money by opting out of towing coverage on your policy. The cost of having our car towed when necessary can actually be less than what you are paying in additional fees for having this coverage. You probably won't use the towing part of the plan, especially since other areas of the policy will cover towing after an accident anyway.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When your insurance coverage is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since they already have all your information, it probably won't take 15 minutes and you can save time and money.

Ask your insurer if there are savings to be had by merging all the different types of insurance that you need. Lots of insurers provide discounts for having all policies with them and combining these policies into one.

It may sound silly but some people even invest in pet insurance! I, as an owner of two dogs, also recommenced it. You simply never know what could happen to your dogs, and they are like members of your family. This protects you in the case of a serious health condition that requires regular treatment. For example I had an epileptic dog growing up and we spent thousands on his care which could have easily been mitigated.

Contact your provider and inquire as to the discounts available for bundling policies. You'll receive a discount for using them for all of your insurance needs, but you'll get an even bigger discount if you merge all of your insurance policies into a single account.

https://s3.ca-central-1.amazonaws.com/financial-advisor-alberta-22/infinite-banking.html at different companies that offer renter's insurance and check their customer satisfaction ratings. You do not want to get coverage from a company that is going to take a long time to pay out a claim or reject it completely. Know who you are getting involved with prior to signing anything.

Be sure to familiarize yourself with car insurance lingo. Understand the meaning of various phrases you will encounter such as collision coverage, uninsured motorist protection, bodily injury liability, property damage liability and so forth. If you don't understand, ask questions. In this way, you will know exactly what you are paying for.

Having pet insurance can typically help with veterinary costs which can be astronomical because of cutting-edge science and procedures. Often time making the choice of choosing an expensive operation over putting the animal to sleep can be heartbreaking and opting to buy an insurance for a pet could prove to be very beneficial if your pet needs expensive health care.

It is very costly to add a teenage driver to your auto insurance policy, so it should only be done under certain circumstances. Only do this if you are positive that your teen is a safe driver and only if they have had driver's education classes, since that will decrease the likelihood of them getting into an accident.

Be sure to familiarize yourself with car insurance lingo. Understand the meaning of various phrases you will encounter such as collision coverage, uninsured motorist protection, bodily injury liability, property damage liability and so forth. If you don't understand, ask questions. In this way, you will know exactly what you are paying for.

If the option is available to you, you should always purchase your insurance from a large insurance company. Small insurance companies frequently go out of business and rarely has the personnel or technology required to provide you with the best customer service. If a small insurance company goes out of business you may lose any prepaid expenses you deposited.

If you have fire insurance and you are getting ready to file a claim, it is important to make sure you have all necessary information available. This way, you get proper coverage. On your claim, make sure to put the condition of the home, the date of the loss, the location of the damage, type of damage and loss, and related injuries.

A good education about insurance is key to everyone today. If you've got good knowledge of the industry, you can make a better decision without having to deal with negative consequences. Now with the information you just acquired you hopefully feel a little better about insurance and all of your questions have been cleared up.